Employee Retention Tax Credit

ERC Business Solutions Reviews: Customer Insights and Company Performance

In this article, we take a comprehensive look at ERC Business Solutions, a company offering credit recovery and business assistance services. We will examine the nature of their services, customer reviews, and performance to help potential users understand the company and make informed decisions.

But Hold On

What's next beyond the ERC?

Beyond the Credit!

Business insurance in a dash: Why do you need business insurance?

Cost Segregation Made Easy: What is Cost Segregation?

R&D Tax credits: What is the Federal R&D Tax Credit Program?

Health and Wellness can be free: What is LHMP?

Helping the self-employed: What is the Families First Coronavirus Response Act and American Rescue Plan?

Company Overview: What is ERC and how

does it help businesses?

ERC: Understanding the Employee Retention Credit

The Employee Retention Credit (ERC) is a government initiative that aims to provide financial relief to qualifying businesses affected by the COVID-19 pandemic. By offering businesses a tax credit, the ERC helps employers retain their employees, maintain payroll continuity, and promote economic recovery.

The role of ERC in mitigating COVID-19 economic impacts

During these challenging times, the ERC plays a vital role in helping businesses survive the economic downturn. By providing financial assistance to companies experiencing a decline in revenue, the credit ensures employee job security and aids in stabilizing the economy.

Employment Retention Credit Company: Bridging the gap for struggling businesses

ERC business solutions are designed to assist businesses who qualify for the Employee Retention Credit program. By offering expert advice, guidance, and assistance, they help businesses submit accurate claims and maximize their credit benefits.

Reviews and Ratings: Is ERC a trustworthy solution for employee retention credit?

Examining customer reviews and company ratings

Customer reviews and company ratings play an essential role in assessing the trustworthiness of ERC providers. Employers should diligently investigate customer feedback and assess the provider's credibility, professionalism, and quality of service before making a decision.

Spotting potential scams in the ERC industry

As with any industry, there may be illegitimate actors in the ERC market. Employers should be wary of providers who refuse to provide accurate information, make false guarantees, or engage in unscrupulous practices. Performing due diligence can help businesses avoid scams and identify legitimate ERC providers.

Trustworthy providers vs. fraudulent actors in the ERC market

Trustworthy ERC providers have a proven track record of success and adhere to IRS guidelines. They strive to offer honest advice and assistance, maintain professionalism, and prioritize customer service. Illegitimate providers, on the other hand, may employ deceptive practices, make unrealistic promises, or solely focus on profit at the expense of client satisfaction.

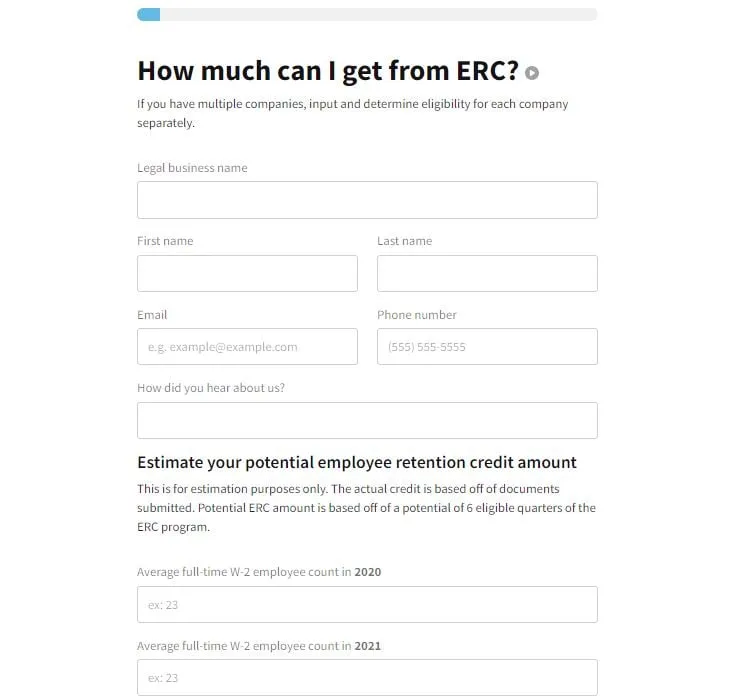

Filing for Employee Retention Credit: How can ERC business solutions assist?

Understanding the ERC claim process

ERC business solutions can guide companies through the complex claim process. Specialist providers help businesses identify credit eligibility, gather necessary documentation, and submit accurate claims, ensuring a smooth application process.

How to identify legitimate providers offering ERC assistance

When identifying legitimate ERC providers, employers should look for companies with a credible profile, positive customer reviews, and a history of professional expertise. Providers should be transparent about their services, fees, and processes and demonstrate a commitment to assisting clients in maximizing their Employee Retention Credit opportunities.

Submitting the necessary documents for a smooth application process

ERC providers may require business owners to submit documentation, such as payroll reports and financial statements, to validate their claim. It's crucial to provide accurate information to expedite the claim process and ensure successful credit approval.

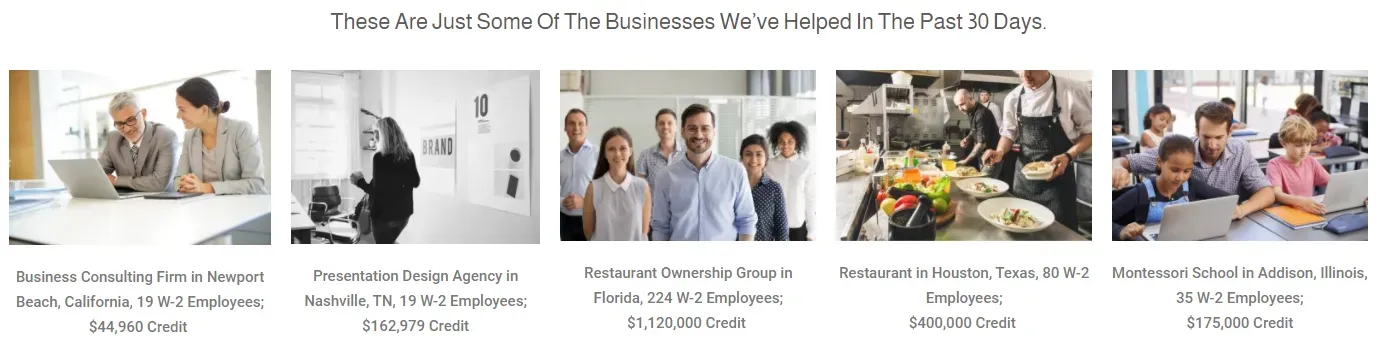

Maximizing Benefits and Guarantees: The value of ERC for businesses

How can ERC contribute to a company's financial stability?

By providing financial relief, the ERC program enables businesses to maintain employment and continue operations in the wake of the pandemic. Securing this credit can help companies reduce the burden of payroll expenses, improve operational cash flow, and enhance overall financial stability.

Exploring refund opportunities and guarantees offered by ERC providers

Some ERC proVerifying your eligibility for the Employee Retention Credit programviders may offer refund guarantees or opportunities, ensuring that businesses receive the maximum credit possible. Employers should carefully assess any guarantees made by providers, verifying their accuracy and checking for hidden fees or costs.

Verifying your eligibility for the Employee Retention Credit program

Before attempting to claim the Employee Retention Credit, employers should confirm their eligibility by reviewing IRS guidelines and assessing the pandemic's financial impact on their company. A legitimate ERC provider can help businesses navigate these requirements and provide expert advice on increasing credit success.

Future Outlook: What to expect from ERC and related business solutions in 2023

Updates on the IRS guidelines for the Employee Retention Credit

As we look ahead to 2023, it's essential to remain informed about updates or changes to the IRS guidelines for the Employee Retention Credit. This will ensure that businesses can continue to access the critical financial support they need to weather the pandemic's ongoing effects.

State-level initiatives to support struggling businesses

In addition to federal ERC offerings, state-level initiatives may provide additional support for struggling businesses. Employers should research and explore various relief programs to maximize their opportunities for financial assistance.

The role of ERC providers in navigating the ever-evolving landscape

Given the dynamic and complex nature of the ERC landscape, trustworthy ERC providers play a crucial role in helping businesses stay up-to-date on changing guidelines, adapt to new requirements, and optimize their chances of securing the Employee Retention Credit.

Frequently Asked Questions

What are the most common ERC Business Solutions reviews FAQs?

The most common ERC Business Solutions reviews FAQs focus on company reviews, scores, ERC reviews, customer service reviews, job titles, whether the company is a scammer, and consumer experiences.

What is the company's average review score, and how is it calculated?

The average review score for ERC Business Solutions can be calculated by taking the sum of all individual review scores divided by the number of reviews received. This offers an overall rating of the company's performance and consumer satisfaction.

Do ERC reviews mention IRS involvement or taxation?

Some ERC reviews may mention experiences related to the IRS or tax issues. However, it's essential to read each review carefully and consider the context to determine if the topic is related to the company's services or the reviewer's specific situation.

Can I trust ERC Business Solutions reviews or are they scammers?

When researching a company, it's important to do your due diligence by investigating multiple sources of information. Look for patterns in customer reviews and analyze the prevalence of scam or fraud accusations to determine whether the company is legitimate or not.

How do consumer experiences with ERC Business Solutions impact job titles and responsibilities?

Consumer experiences can impact job titles and responsibilities at ERC by providing feedback on how well employees perform in their roles. This information can lead to job title changes or adjustments in responsibilities to improve customer satisfaction.

What is the role of a specialist in the company, and how do they assist customers?

A specialist at ERC Business Solutions focuses on a specific area of expertise and is responsible for assisting customers in resolving their concerns. Their role may involve investigating issues, providing accurate advice, and ensuring overall customer satisfaction.

Can I request a refund or money back from ERC?

If you are unsatisfied with the services provided by ERC, you can request a refund or your money back. It is essential to communicate your issues with the company diligently and follow their guidelines for requesting refunds.

How do ERC Business Solutions reviews impact the company's credit report and collection practices?

ERC reviews can influence the company's credit report by providing insights on customer experiences regarding their attempts to collect debts. Negative reviews may indicate issues with the company's collection practices or inaccuracies that need to be addressed for future interactions.

How do I know if a review is legitimate, or if it's an illegitimate complaint?

Determining the legitimacy of a review can be challenging, but it is essential to look for patterns in reviews and assess the detailed information provided by the reviewer. Illegitimate complaints may be vague or offer limited context, while legitimate reviews typically provide specific accounts of the consumer's experience.

How does ERC address rude customer service reviews?

ERC Business Solutions takes customer service reviews seriously and should work to address any reported instances of rudeness. The company may investigate the situation, take corrective action when necessary, and work to improve their overall customer service experience.

Conclusion

As we enter 2023, the Employee Retention Credit (ERC) remains a vital tool for businesses striving to maintain financial stability in the wake of the COVID-19 pandemic. By understanding the role of ERC providers and carefully navigating the landscape, employers can secure the support they need to retain their employees and bolster their financial future.

ERC providers offer indispensable assistance in comprehending the intricacies of the credit program. They guide businesses through the claim process, ensuring eligibility requirements are met, accurate documentation is submitted, and claims are filed promptly. Employers should exercise caution when selecting an ERC provider, thoroughly examining customer reviews, and assessing their credibility and professionalism.

While trustworthy ERC providers prioritize customer service and adhere to IRS guidelines, it is essential to remain vigilant against fraudulent actors in the market. Illegitimate providers may engage in deceptive practices or make unrealistic promises. Employers should perform due diligence to avoid scams and select providers with proven success records, positive reviews, and transparent processes.

By securing the ERC, businesses can significantly contribute to their financial stability. The credit alleviates payroll expenses, improves operational cash flow, and helps companies weather the economic challenges posed by the pandemic. Employers should also explore refund opportunities and guarantees offered by ERC providers, verifying their accuracy and uncovering any potential hidden costs.

Looking ahead to 2023, staying informed about updates to IRS guidelines for the ERC is crucial. Businesses must remain adaptable and be aware of state-level initiatives that may offer additional support. ERC providers continue to play a pivotal role in navigating this ever-changing landscape, ensuring that businesses stay up-to-date on the evolving requirements and maximize their chances of securing the Employee Retention Credit.

As we forge ahead into a post-pandemic era, businesses can rely on ERC business solutions to be their partners in financial stability, assisting them in accessing the relief and support they need to thrive in the face of adversity.

© 2023 Ercbusinesssolutionsreviews.com. All Rights Reserved.